Public-safety LMR licensing activity increases in 2021, but business sector still struggles

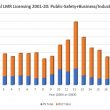

As expected, land-mobile-radio (LMR) licensing activity in the public-safety and business-industrial sectors rebounded from all-time low levels in 2020, but the growth was not as strong as many industry observers had expected, given favorable changes in the economic and regulatory environments during 2021.

Public-safety LMR licensing jumped significantly in 2021, as 3,124 applications were filed—78 of which are still pending approval—according to information from the FCC’s Universal Licensing System (ULS) online database that has been in existence since 2001. This 13.1% increase from the record-low 2,763 public-safety licenses in 2020 represents the first growth in public-safety LMR licensing since 2012, ending a streak of eight consecutive years in which public-safety LMR licensing activity decreased.

This 2021 increase in public-safety LMR licensing was expected, as officials for LMR manufacturers—for instance, Motorola Solutions CEO Greg Brown—have noted that pandemic-driven stoppages in 2020 typically meant projects on mission-critical communications systems were not cancelled but merely were being delayed.

Public-safety LMR figures received a boost from the FCC allowing LMR systems that operate on T-Band spectrum (470-512 MHz) in key metropolitan markets to implement significant changes for the first time since 2012. Notably, Los Angeles County submitted 83 licensing applications on March 22, soon after the T-Band freeze was lifted.

Without this one-time boost from pent-up T-Band activity, the public-safety LMR licensing figures likely would have been similar to the pre-pandemic all-time low record of 3,060 license applications submitted in 2019. With the T-Band activity, the 2021 figures almost certainly will exceed the 3,056 public-safety LMR licenses approved in pre-pandemic 2019, albeit by a narrow margin.

Public-safety LMR licensing numbers in 2021 were bolstered by the 213 license applications granted during the year to state of Florida, which awarded a contract last spring to L3Harris to build a statewide P25 system. The state of Georgia submitted 210 public-safety LMR licensing applications during 2021.

Among public-safety frequency coordinators, the Association of Public-Safety Communications Officials (APCO) was the most active, submitting 59.6% of all public-safety LMR license applications in 2021.

LMR licensing activity in the enterprise sector struggled during 2021, reflecting a market weakness cited by LMR manufacturers throughout the year. With the boost received from about 200 license applications received from enterprises with LMR networks that operate on T-Band frequencies, the number of business-and-industrial license applications in 2021 was 9,618. This figure represents a 1.7% increase in business-industrial licensing activity over the record-low 9,460 applications submitted by the sector in 2020, but it still is the second consecutive year in which the total has been less than 10,000.

With more than 1,000 business-industrial LMR license applications still pending approval, it is possible that the final total of approved licenses—currently 8,597—will not top the all-time-low figure of 9,440 granted licenses that was posted in 2020.

Officials for LMR manufacturers have noted supply-chain issues that have had a greater impact on enterprise LMR systems than on public-safety radio networks. The business-industrial sector also has seen more replacement of radio communications with push-to-talk-over-cellular (PoC) technology than in the public-safety realm, where mission-critical-push-to-talk (MCPTT) services have yet to prove their real-world reliability, according to industry sources.

Of the spectrum coordinators serving the business-industrial market, the Enterprise Wireless Alliance (EWA) was the most active, submitting 58.5% of the enterprise LMR license applications in 2021.